Obsessed with Conducting a Rigorous and Objective Due Diligence

4 Key Variable Research Driven Acid Test

No Conflicts of Interest (No Overlapping Mandates)

Primarily Focused on US & EU Fund Managers (Flight to Quality)

Rigorous Screening (Sector, Strategy & Geographic Focus)

ROAM Capital:

- Is highly selective in its client selection process

- Will not engage fund managers with competing strategies. We live by a ‘no-conflicts’ policy

- Prioritizes investor needs by seeking clients with varying sector and geographical strategies with a core focus on providing options for agile diversification

>200 Prospective Fund Managers

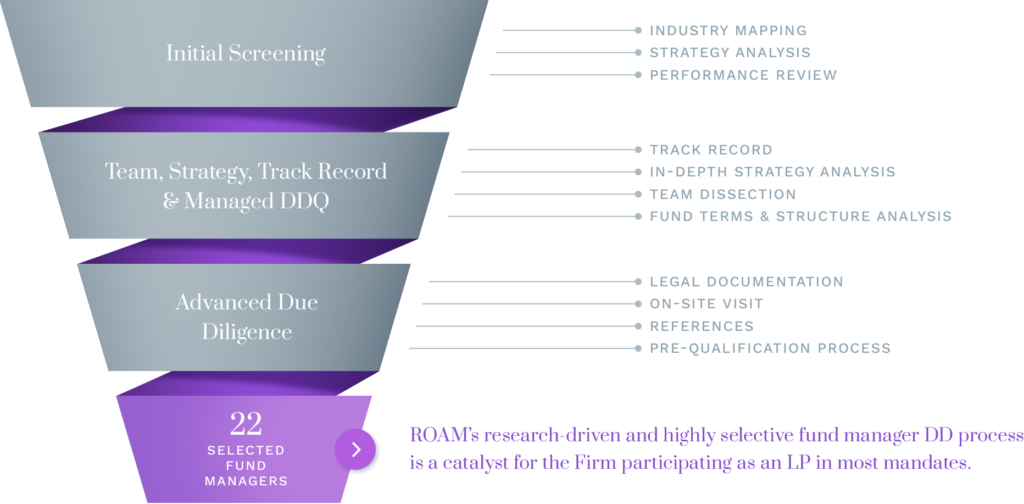

ROAM’s rigorous Due Diligence efforts and focused manager selection process yields world-class General Partners with primarily “top quartile” returns

ROAM Capital Methodology:

All of ROAM Capital’s research processes and efforts are grounded in the best international industry practices and guidelines. We closely follow ILPA’s and PRI’s publications, recommendations, and subscribe to leading research platforms such as Preqin, Cambridge Associates, Bain & Co, and Pitchbook. Additionally, we receive daily newsletters (e.g. Private Equity International and PERE), which help us keep track of industry trends, stay on top of fund manager related news, as well as continually assess the competitive landscape. Finally, throughout the years, we have built a digital library inclusive of most of the seminal academic papers related to private equity capital and alternative investments deployment (i.e. Steven N. Kaplan)

ROAM Capital’s deep research-driven approach is one of our firm’s core differentiators as a placement agent in Latin America and is one of the attributes that our investor base values the most. For many of them, we have become one of their most trusted information source for industry research, preliminary analysis on funds offered to them, and on fund managers that are targeting them directly, or through other placement agents

Since our inception, ROAM Capital has proactively researched private, alternative investments markets across dozens of asset classes and global regions, looking for “best of breed” fund managers (proven top-quartile track records, team stability, and strong interest alignment). As a result of this research, we establish relationships with top-performing managers early on who have not previously raised Latin American capital and whose strategies are aligned with the asset allocation plans of our institutional investor base

ROAM Capital has close relationships with all of the relevant institutional allocators in Latin America. Through consistent communication and networking, we maintain access to privileged insights on their current portfolios, pipelines, asset allocation plans, and overall investment strategies. Moreover, we monitor their regulatory fillings closely to track which new fund managers are being included in their portfolios as well as assess other relevant metrics related to their portfolios which allows us to identify unique, alternative placement opportunities. Lastly, we attend several industry events each year, and in the case of Colombia specifically, we are a member and sponsor (and award recipient) of the Colombian Private Equity Association ColCapital

For each of our placement mandates ROAM:

- Conducts a rigorous due diligence process, with a comprehensive focus on four key variables: (1) team, (2) strategy, (3) track record, (4) fund terms and structure. This rigorous due diligence process is summarized in a proprietary research-driven “Scorecard” which is updated frequently

- Develops several Peer Group Analyses based on Preqin and Cambridge Associates benchmarks so that our investors can assess the opportunity cost they face by investing in a particular mandate

- Composes detailed introductory and updated investor emails, both in Spanish and English, and advises fund managers in the tailoring of their marketing materials (pitchbook, teaser, etc.) for the Latin American market

- Identifies third-party research reports and news articles geared towards the investment strategy and/or asset class of our mandate. This provides valuable touchpoints for our marketing team that assist and complement our fundraising effort

ROAM Capital Sample Scorecard

Fund managers in the ROAM Capital platform must meet or exceed a comprehensive four key variable proprietary Scorecard analysis:

ROAM Capital Sample Peer Group Analysis

ROAM’s internal research capabilities afford investors with in-depth fund manager and opportunity set analysis: